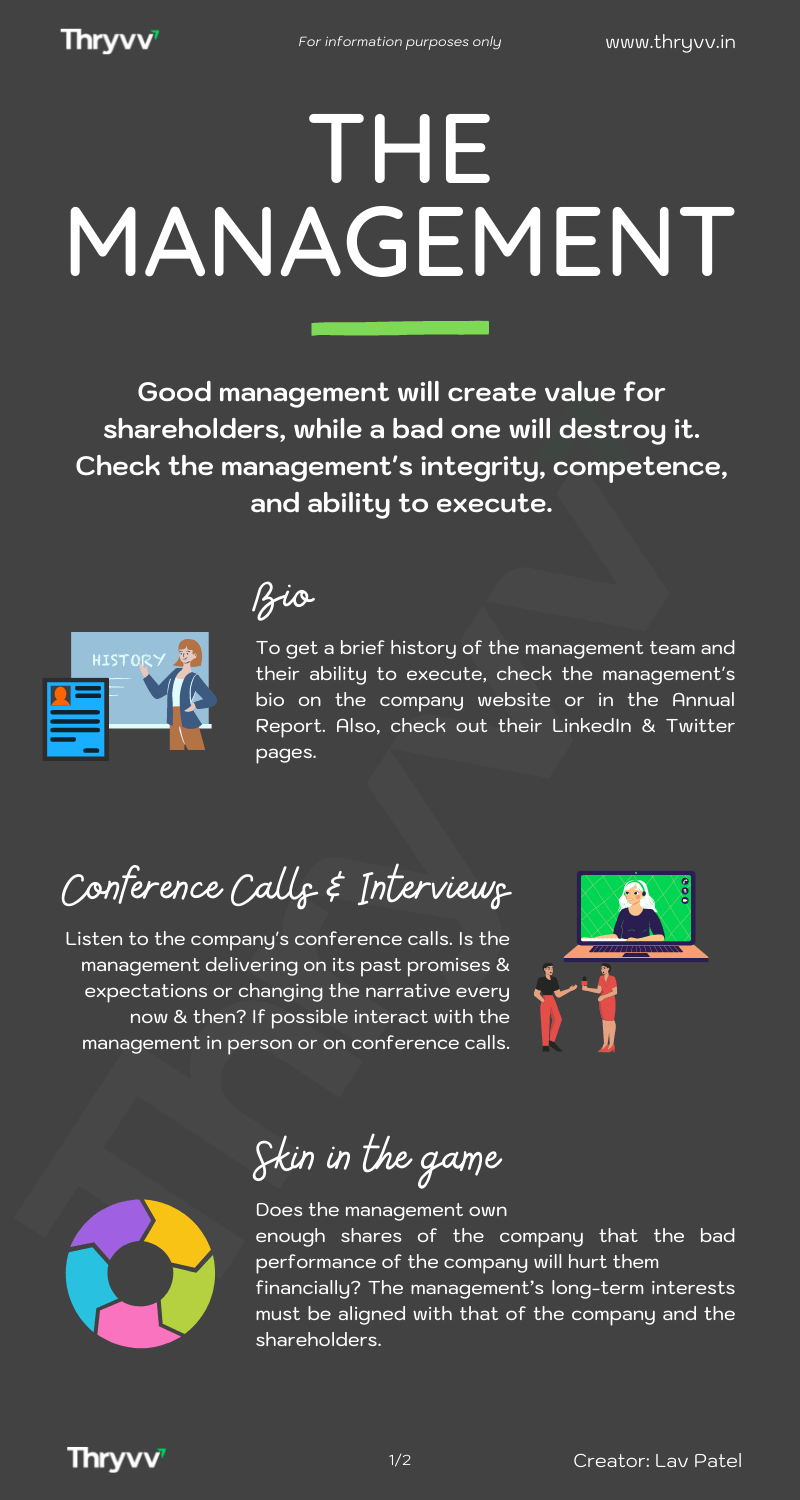

The Management

Good management will create value for shareholders, while bad management will destroy it. Check the management’s integrity, competence, and ability to execute.

High management integrity is the first attribute that an investor should look for while researching a company. If you cannot trust the company management to do right by the minority shareholders, no amount of undervaluation is enough to justify holding the shares of such a company as a minority shareholder.

High management integrity is the first attribute that an investor should look for while researching a company. If you cannot trust the company management to do right by the minority shareholders, no amount of undervaluation is enough to justify holding the shares of such a company as a minority shareholder.

Listening to management interviews, listening to quarterly and annual conference calls, looking at the company shareholding patterns, talking to current &/or past employees, looking at the past execution record of the management and the past job history are some of the primary ways to gauge management quality. An investor should be trying to gauge the competence of the management, their understanding of the business and the industry within which they operate, their reasoning, and most importantly the integrity of the management.

Management competence is usually easy to track and understand as most companies provide a bio  of their management and board of directors on their website. Also checking out LinkedIn & Twitter pages of the management team can be a good idea.

of their management and board of directors on their website. Also checking out LinkedIn & Twitter pages of the management team can be a good idea.

Listening to management interviews and conference calls should provide you with an idea of the management’s understanding of their own business and the industry. This is a very important advantage for the company. If the management is up to date with the latest trends and innovations happening within their industry, they are more likely to take action in a timely manner to take the company forward and be a leader in their industry.  Also paying close attention to the reasoning that the management provides when something unexpected happens, can often give you indications about the quality of the management. Another important thing to check is whether the management is doing what it says during their interviews and conference calls or do they keep on changing their commentary and reasons every now and then? It is always a good idea to take notes of the important points when you listen to management interviews and conference calls and check these notes again during the next round of interviews and conference calls to see if the management is walking the talk or just bluffing every now and then.

Also paying close attention to the reasoning that the management provides when something unexpected happens, can often give you indications about the quality of the management. Another important thing to check is whether the management is doing what it says during their interviews and conference calls or do they keep on changing their commentary and reasons every now and then? It is always a good idea to take notes of the important points when you listen to management interviews and conference calls and check these notes again during the next round of interviews and conference calls to see if the management is walking the talk or just bluffing every now and then.

Another important thing to consider is the skin in the game. i.e. does the management own enough shares of the company that the bad performance of the company will hurt them financially? It is very important that the management’s long-term interests are aligned with that of the company and the shareholders.

If time permits, interacting with the company management in person can also provide  subtle hints about the quality of the management. Though it would be a time and energy-consuming effort, reaching out to channel partners (distributors, suppliers, etc) and current or past employees, can also provide valuable insights to support your understanding of the quality of the management team. Current or past employees are usually one of the best sources to understand management quality and integrity.

subtle hints about the quality of the management. Though it would be a time and energy-consuming effort, reaching out to channel partners (distributors, suppliers, etc) and current or past employees, can also provide valuable insights to support your understanding of the quality of the management team. Current or past employees are usually one of the best sources to understand management quality and integrity.

Check the past capital allocation records of the management. Did it generate acceptable returns? Was it in the best interest of the company & its shareholders? Was it a case of over-diversification? Was the capital allocated to ego projects?

Also, check management compensation compared to peer companies. Is it within acceptable limits? Are stock options &/or warrants granted to the management too generous? Are loans being given to the promoters at low or zero interest rates? Are related-party transactions being done fairly?

Below is a nice graphic version of the above information.

Disclaimer: The information provided here is for information purposes only. It should not be taken as investment advice. Please consult your investment advisor before making investment decisions.