Manyavar: A bet on the growth of the big fat Indian weddings!

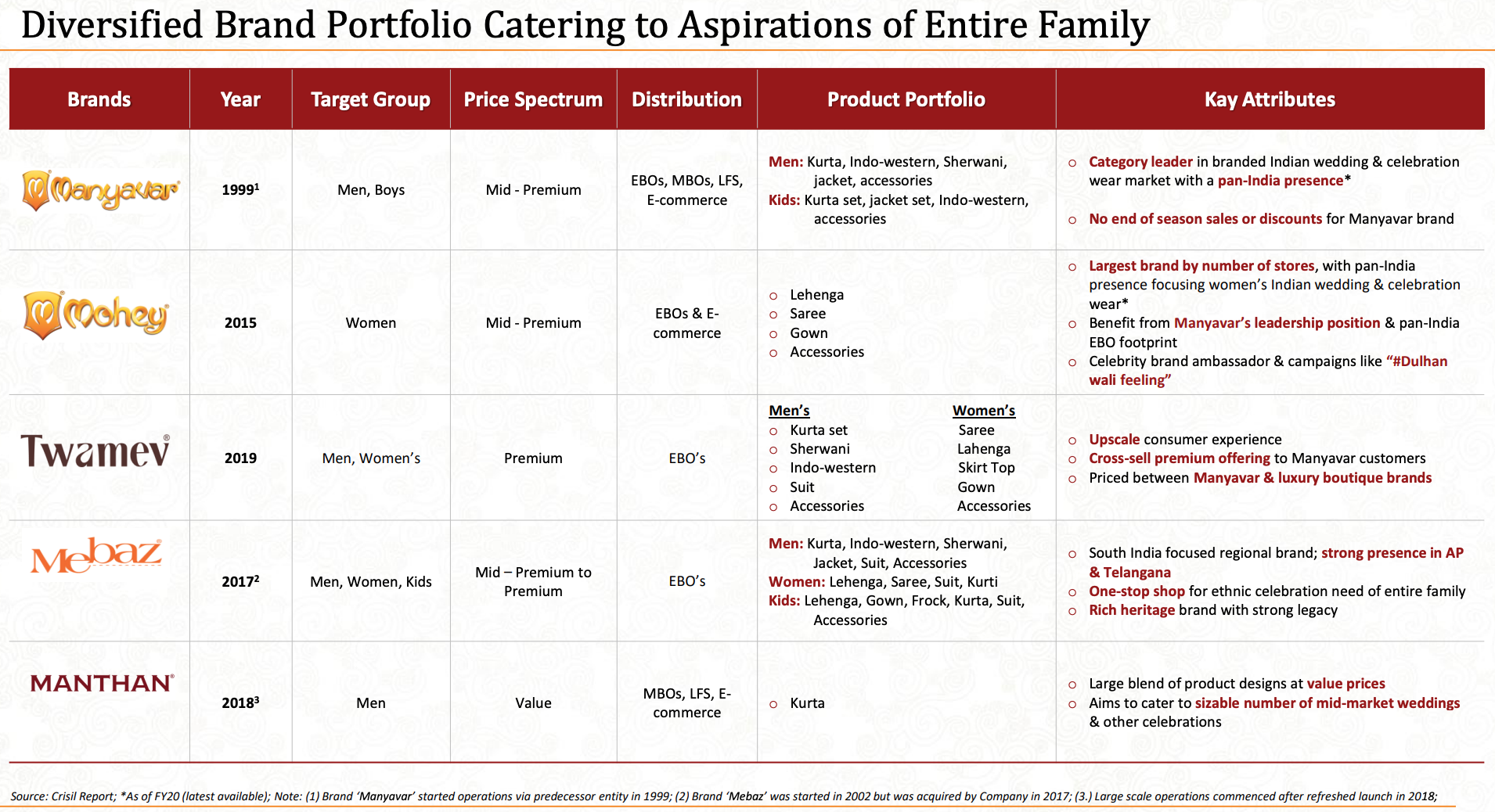

– Manyavar, Mohey, Twamev, Mebaz, and Manthan all cater to different segments of traditional wear shoppers.

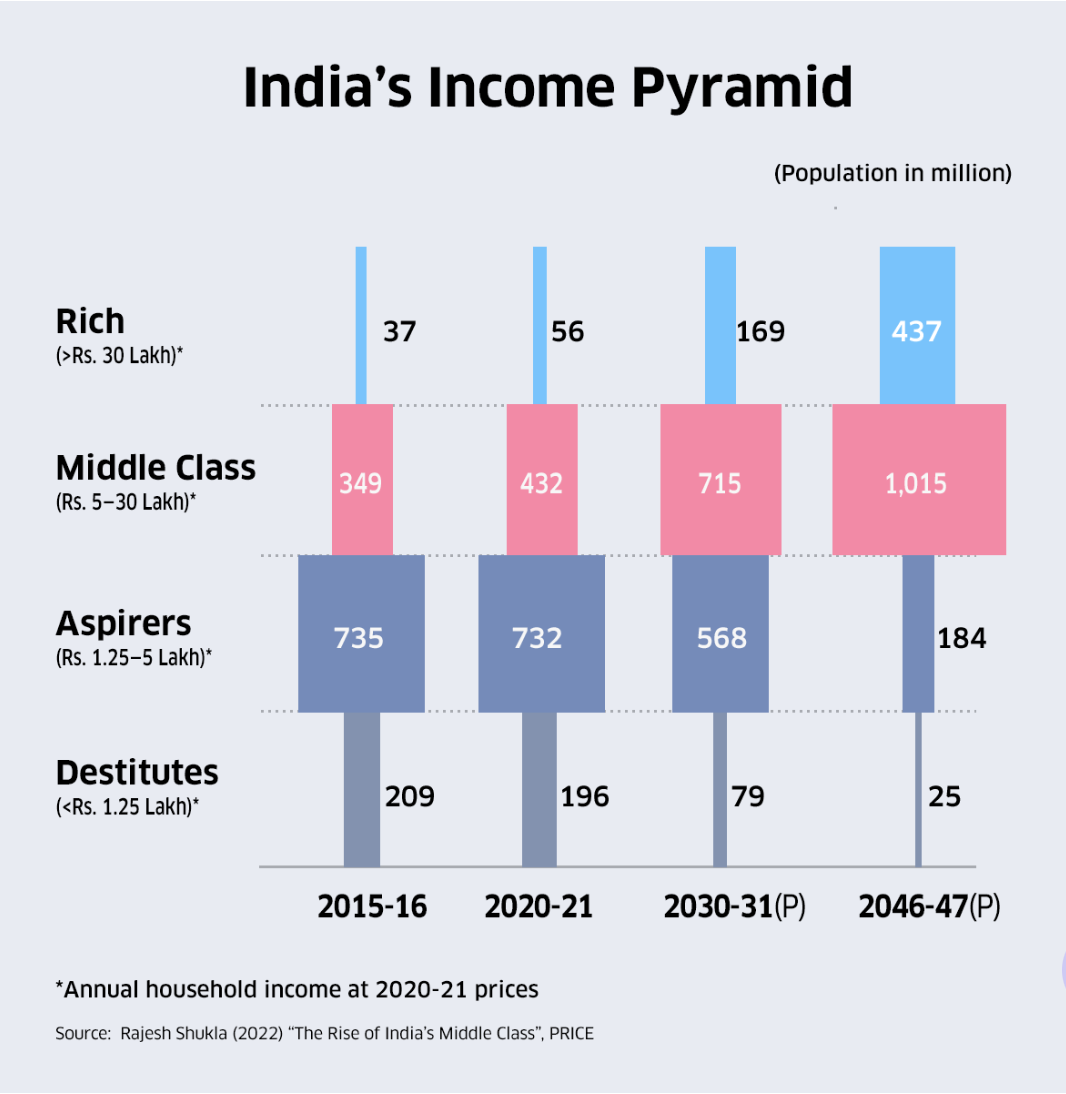

– The rising “Middle Class” and the “Rich” category in India is likely to be a long tailwind for Vedant Fashions.

– A possible shift from unorganized to organized players is likely to benefit Vedant Fashions.

– The appeal of a nationally recognized brand, in-trend designs, better customer service & quality, and a coordinated marketing effort should help Vedant Fashions grow into a go-to shopping destination for all things traditionally Indian.

Manyavar is a brand that almost everyone in India who is shopping for a wedding ought to have heard of. The article here tries to shed light on the business, its prospects, and its valuation.

A Brief about the company

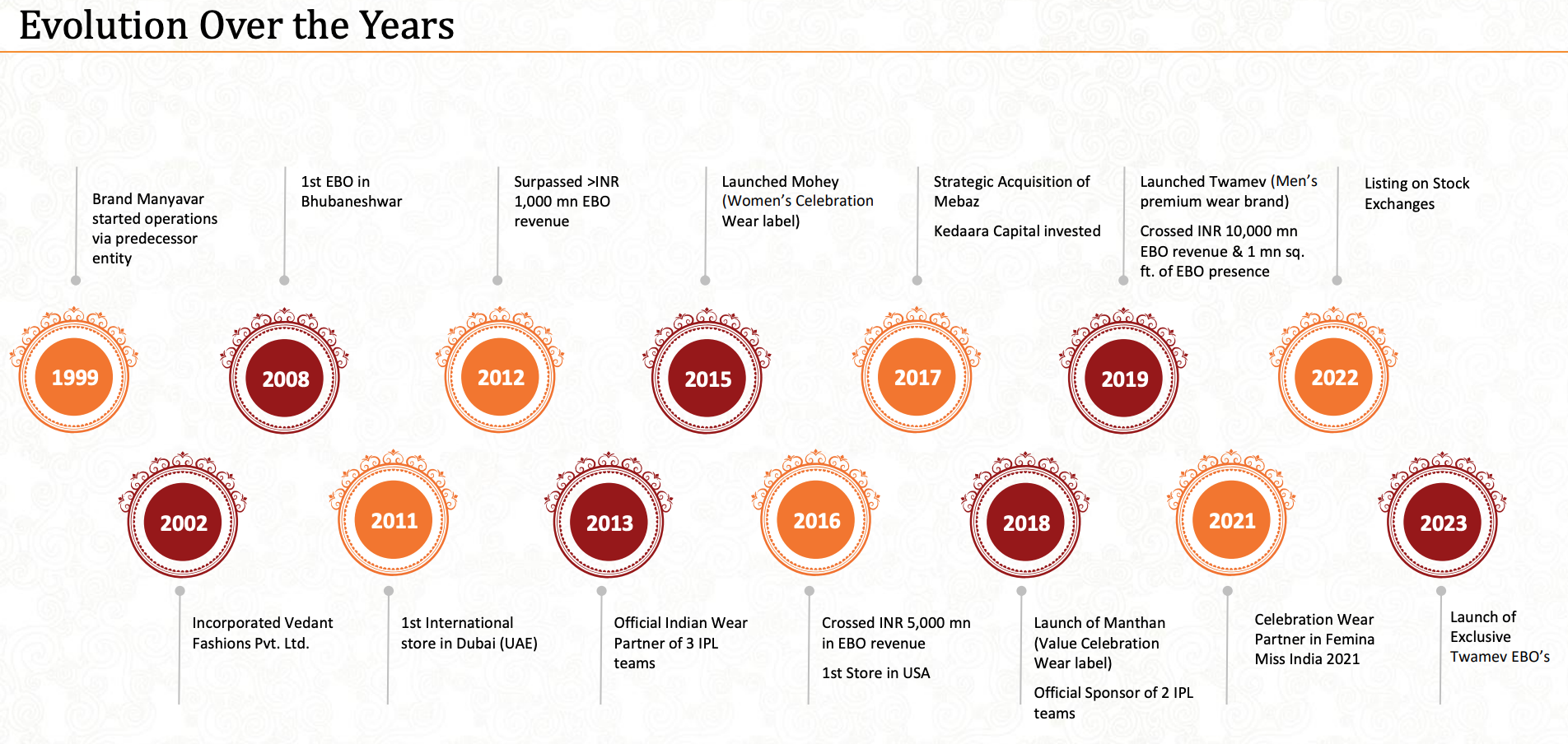

The brand Manyavar started in 1999 and its journey from 1999 until now has been filled with great execution, international expansion (16 overseas Exclusive Brand Outlets) in USA, UAE, Canada, and UK, a strategic acquisition like Mebaz, pan India presence in 248 cities and towns, and the launch of three new brands under Mohey, Twamev, and Manthan; all targeting different audiences and strata of the society.

Source: Vedant Fashions November 2023 Investor Presentation

Manyavar is a mid-premium brand for men and boys. It operates through its EBOs (Exclusive Brand Outlet), MBOs (Multi Brand Outlet), LFS (Large Format Store), and E-Commerce. Manyavar is a category leader in the branded Indian wedding & celebration wear market with a pan-India presence.

Mohey is a mid-premium brand that was launched in 2015 and it is targeted towards women. It operates through EBOs, and E-Commerce. Mohey is the largest pan-India brand focused on women’s Indian wedding & celebration wear.

Twamev is a premium brand for men and women. It was launched in 2019. It operates only through its EBOs, where the customers receive an upscale experience. Twamev is priced between Manyavar/Mohey and luxury boutique brands like Manish Malhotra, Sabyasachi, etc. The ASP (Average Selling Price) at Twamev is around 3x that of Manyavar and 2x that of Mohey. Hence, a big success at Twamev can make a significant contribution to Vedant Fashion’s total revenue and growth.

Vedant Fashion acquired Mebaz in 2017. Mebaz is a mid-premium to premium brand that caters to men, women, and kids. Mebaz is a south-India-focused regional brand with a strong presence in Andhra Pradesh and Telangana. It operates only through its EBOs.

Manthan was launched in 2018. It is a value brand that caters to men. It operates through MBOs, LFS, and E-Commerce.

Source: Vedant Fashions November 2023 Investor Presentation

Future Prospects

Manyavar aims to expand its reach with 1000 exclusive stores across 300 cities. As per the Q2 FY24 report, Vedant Fashion has 669 EBOs across 248 cities and towns. So growing the number of EBOs and expanding the presence across more cities will bring in growth over the long term.

According to a survey by PRICE (People Research on India’s Consumer Economy), the percentage of households in the “Rich” category (Households with income greater than Rs. 30 lakhs at 2020-2021 prices) is forecasted to increase from 56 million in 2020-2021 to 169 million in 2030-2031, and the percentage of households in the “Middle Class” category (Households with income between Rs. 5 lakhs to Rs. 30 lakhs at 2020-2021 prices) is forecasted to increase from 432 million in 2020-2021 to 715 in 2030-2031. The “Rich” category is further forecasted to increase to 437 million in 2046-2047 and the “Middle Class” category is further forecasted to increase to 1015 million in 2046-2047. This is likely to result in a higher percentage of people buying Indian traditional clothes from premium stores like Twamev. This shift of customers to Twamev is likely to accelerate the revenue & profit growth for Vedant Fashion. Increasing GDP per capita is also likely to result in higher ASP (average selling price) for Vedant Fashion across all its brands. This increase in GDP per capita is also likely to result in higher spending for Indian Traditional clothes during festivals like Diwali, Raksha Bandhan, Eid, etc.

Source: PRICE Survey

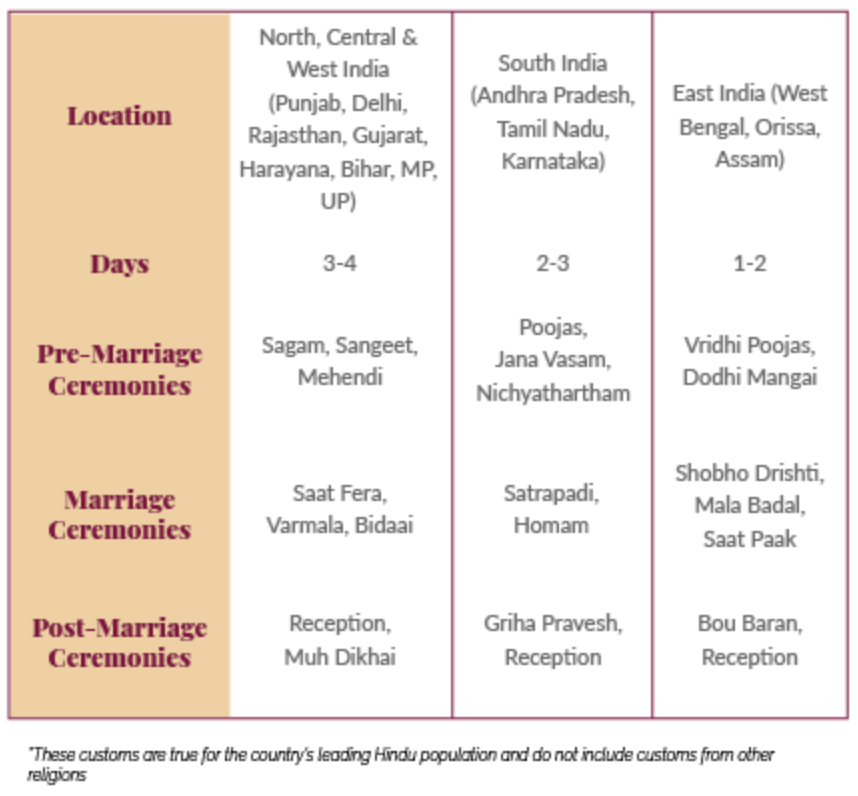

The big fat Indian weddings are becoming fatter by the day. In the past, there was no concept of a separate pre-wedding photo shoot. But now a majority of the bride & groom are opting for a separate pre-wedding photo shoot, which in turn means that the number of unique Indian traditional clothes that a bride, and groom needs is higher than before. Also, the number of events per wedding (Ring Ceremony, Sangeet, Mahendi, Marriage/Wedding day, Reception, etc) has increased compared to the past, which again means a higher number of unique Indian traditional clothes per wedding.

Movies and Social Media have also influenced the wedding industry in a big way. Nowadays, the bride, groom, and attendees all spend a higher amount on their clothes since they all want to look good, take pictures, and post them on Social Media.

DCF Valuation

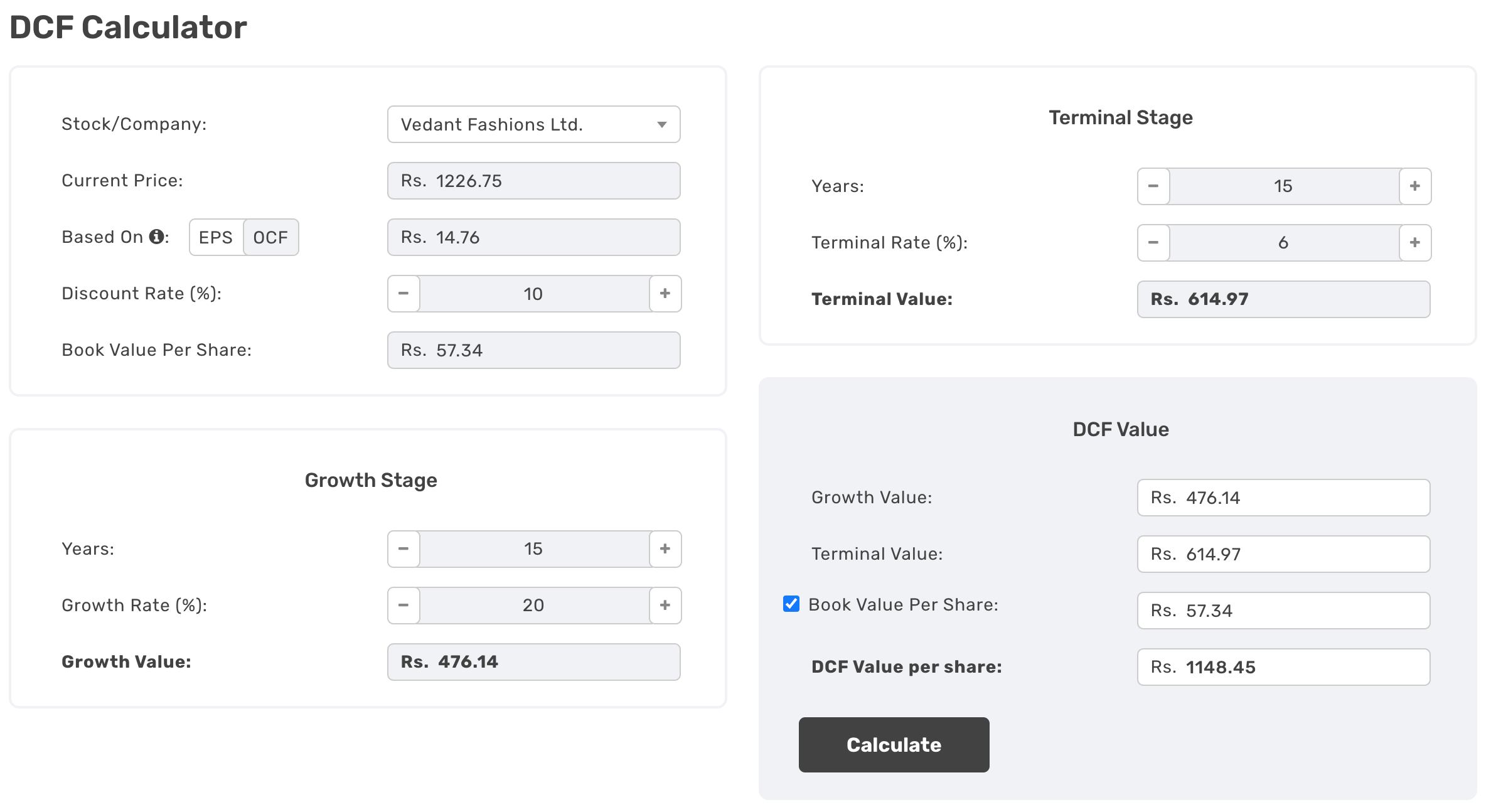

To arrive at a fair value, I have assumed that Vedant Fashion will grow at 20% CAGR for the next 15 years and then grow at 6% CAGR (Inflation rate) for the next 15 years. Since weddings are a tradition that has carried on for centuries, I am cautiously optimistic about the longevity of the business and hence I have assumed 15 years of growth and 15 years of terminal growth. And for a business like Vedant Fashion, I believe the operating cash flow per share is a better indicator than earnings per share. Of course, your assumptions and thoughts about Vedant Fashion are likely to be different than mine. It is likely that some of you might be more optimistic about the business and some might be more pessimistic about it. You can play with the DCF calculator on www.thryvv.in and see what fair value you arrive at. If I input my assumptions, I get a fair value of Rs. 1148.

Source: https://www.thryvv.in/dcf-calculator/

Source: https://www.thryvv.in/dcf-calculator/

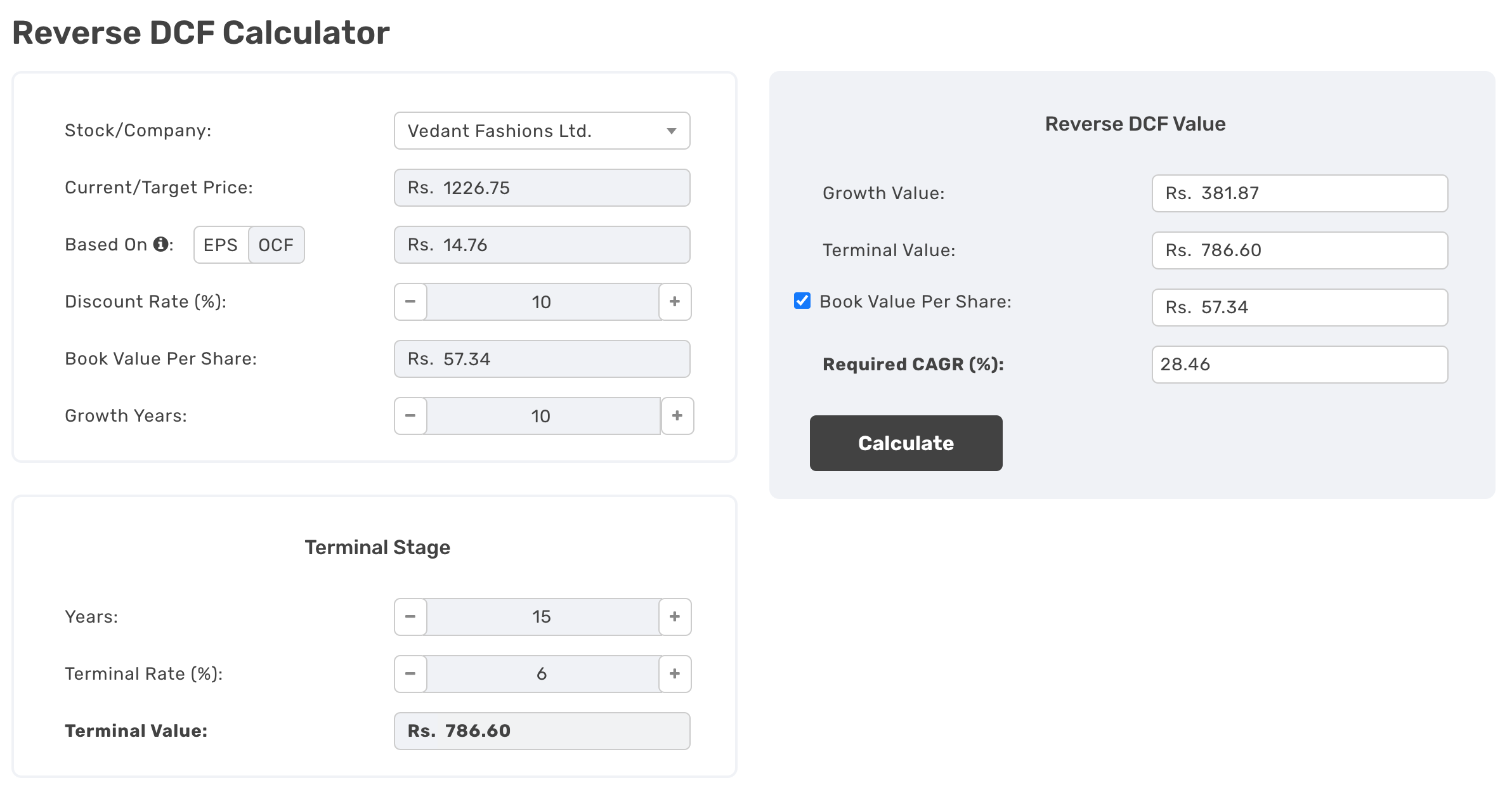

Reverse DCF Calculations

For the reverse DCF, I wanted to check what the required CAGR would be if I limit the number of growth years to only 10 and keep other assumptions as they are in the DCF calculations. The calculator at www.thryvv.in shows that the required CAGR for the 10 years would be 28.46%. You can try varying the number of years and other variables as you like and see what you arrive at.

Source: https://www.thryvv.in/reverse-dcf-calculator/

Source: https://www.thryvv.in/reverse-dcf-calculator/

Concluding Thoughts

I like the business that Vedant Fashion is into. I also like the growth prospects of the business because they were able to identify gaps and introduce brands like Twamev and Manthan to cater to customers in those gaps. I will be monitoring the Twamev story closely since it can lead to a much higher average selling price and impact the bottom line significantly. I am a bit worried about the competition from designer brands like Manish Malhotra, Sabyasachi, and others. Local competitors and designer boutiques can also impact Vedant Fashion’s business. Being an organized national player should help Vedant Fashion keep its costs in control. The appeal of a nationally recognized brand, in-trend designs, better customer service & quality, and a coordinated marketing effort should help it grow into a go-to shopping destination for all things traditionally Indian.

I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.