Company’s Future

Focus on understanding where the company is headed. A majority of the stock’s future performance will be determined by how the company does in the future. While it is important to understand the company’s past and the present, a lot more time should be spent on understanding the company’s future. If you spend too much time analyzing the company’s financial statements via complex spreadsheet models and do not spend enough time understanding the company’s future prospects, you are missing the forest for the trees. Eg: Saregama India Ltd. has gone through such a transformation over the last decade that most investors who focused just on the financial statements and the past, completely failed to understand the impact that the new initiatives (Carvaan, the streaming trend, and Yoodlee Films) were having on the company’s future.

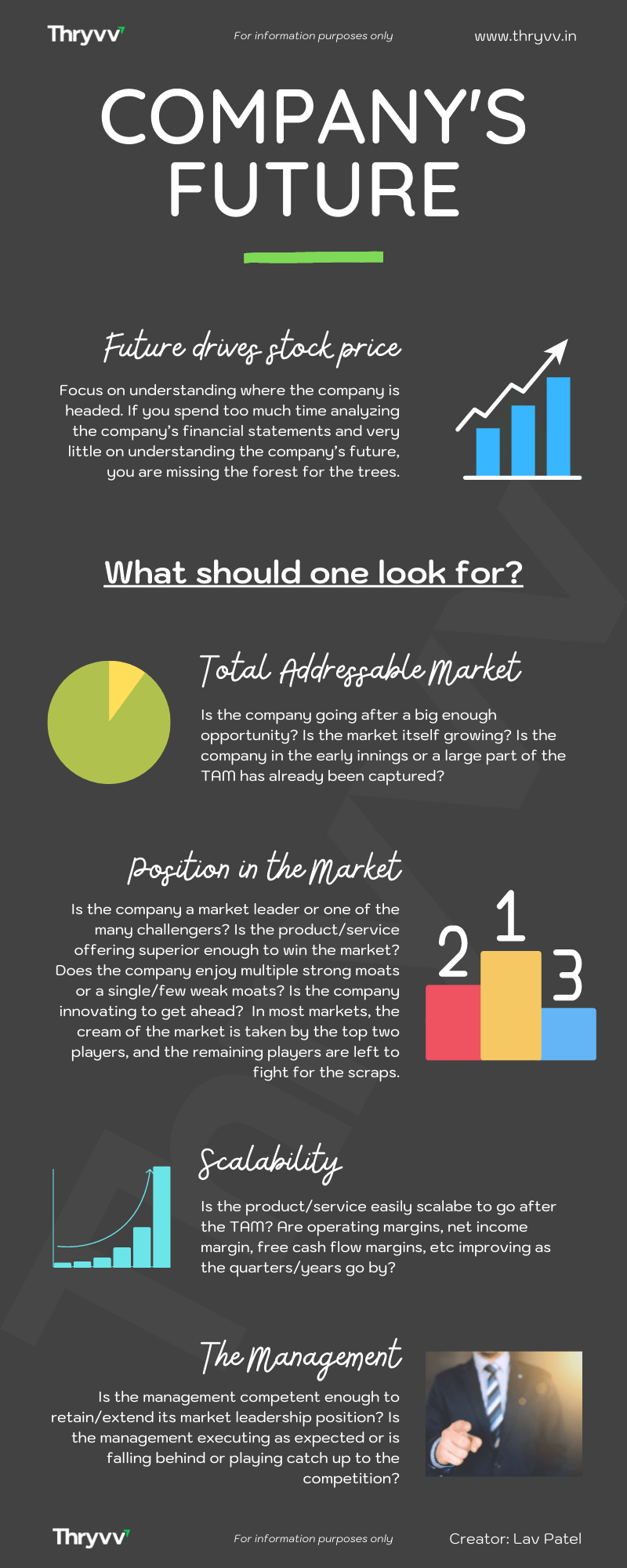

What should one look for when trying to understand the Company’s Future?

The first thing to look at is the Total Addressable Market (TAM) or the Opportunity Size. Is the company going after a big enough TAM that it can keep on growing at a decent rate for a long time? Is the Market itself growing so that the TAM will also keep on increasing as the years go on? Is the company in its early innings of capturing the TAM or a large portion of the TAM has already been captured? If a lot of the market has already been captured and the market itself is not growing then the company’s growth rate will slow down and the company might be forced to look for opportunities in an adjacent market or a completely different market. And all this brings significant risks in terms of needing fresh capital, execution, competition, etc.

The first thing to look at is the Total Addressable Market (TAM) or the Opportunity Size. Is the company going after a big enough TAM that it can keep on growing at a decent rate for a long time? Is the Market itself growing so that the TAM will also keep on increasing as the years go on? Is the company in its early innings of capturing the TAM or a large portion of the TAM has already been captured? If a lot of the market has already been captured and the market itself is not growing then the company’s growth rate will slow down and the company might be forced to look for opportunities in an adjacent market or a completely different market. And all this brings significant risks in terms of needing fresh capital, execution, competition, etc.- The second thing to consider is the company’s position in the market. Is it a market leader or one of the many challengers trying to challenge the market leader?

If it is one of the many challengers, it becomes extra important to understand the company’s product/service offering. Is the product/service offering superior to the competition and if it is being innovated so that it can genuinely become a market leader or a strong second player? Does the company enjoy a strong moat (sustainable competitive advantage)? Moats can be of various types like patents, brands, licenses, scale advantage, network effects, etc. Does the company enjoy multiple strong moats or a single/few weak moats? In most markets, the cream of the market is taken by the top two players, and the remaining players are left fighting for the scraps.

If it is one of the many challengers, it becomes extra important to understand the company’s product/service offering. Is the product/service offering superior to the competition and if it is being innovated so that it can genuinely become a market leader or a strong second player? Does the company enjoy a strong moat (sustainable competitive advantage)? Moats can be of various types like patents, brands, licenses, scale advantage, network effects, etc. Does the company enjoy multiple strong moats or a single/few weak moats? In most markets, the cream of the market is taken by the top two players, and the remaining players are left fighting for the scraps. - The third aspect to look at is scalability. Is the product/service easily scalable to respond to the huge TAM? If the product/service is easily scalable you will see operating leverage kick in as the quarters/years go by. i.e you will see that operating margin, net income margin, free cash flow, etc will increase exponentially as the quarters/years go by. If the product/service is not easily scalable, the opposite will happen. i.e. there will be little to zero improvement in the previously mentioned metrics.

- The fourth aspect to consider is management competency & execution. Is the management competent enough to retain/extend its market leadership position? Is the management executing as expected or is falling behind or playing catch up to the competition? A lot more has been discussed about “The Management” in this dedicated article here.

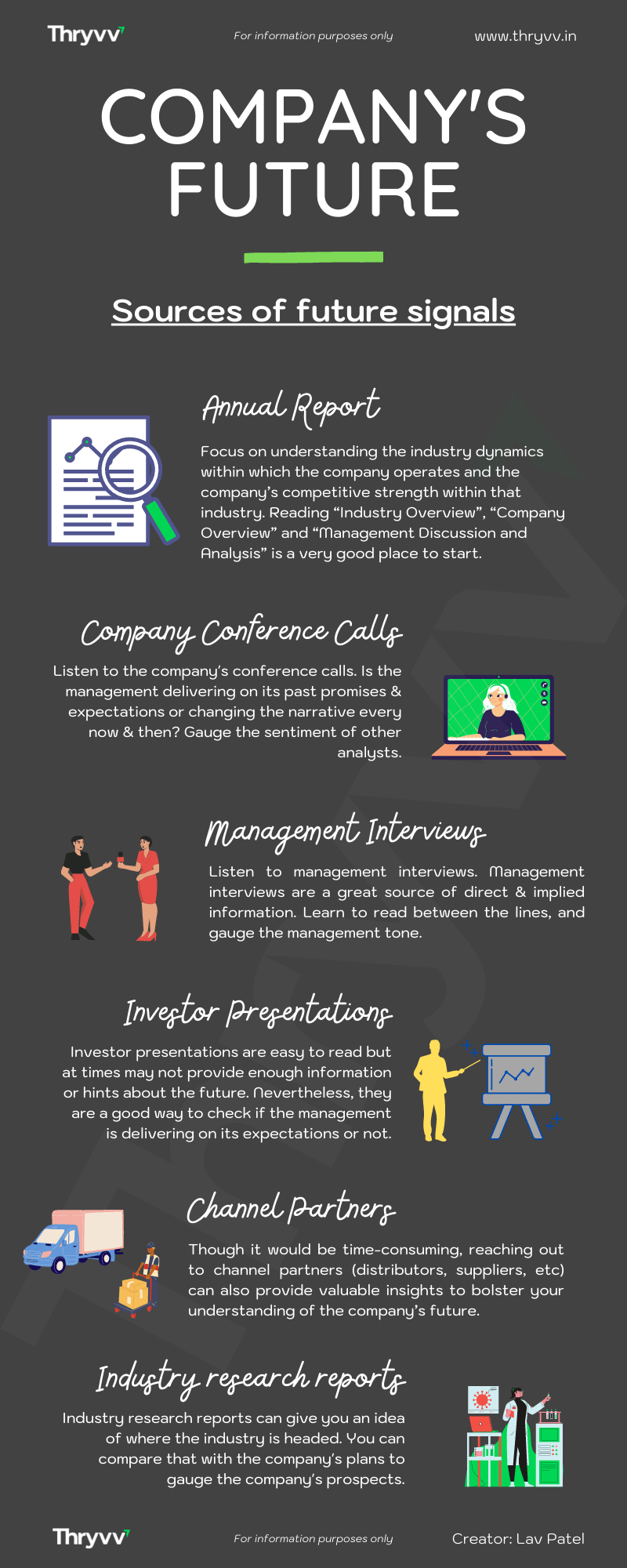

What are some resources that can help in understanding the company better?

- First is the company’s annual report. You do not need to read the whole report, you just need to focus on understanding the industry dynamics within which the company operates and the company’s competitive strength within that industry. Reading “Industry Overview”, “Company Overview” and “Management Discussion and Analysis” is a very good place to start.

The next step is to listen to company conference calls and management interviews. Is the management delivering on its past promises & expectations or changing the narrative every now & then? Gauge the sentiment of other analysts on the call. If time permits, interacting with the company management in person can also provide subtle hints about the future.

The next step is to listen to company conference calls and management interviews. Is the management delivering on its past promises & expectations or changing the narrative every now & then? Gauge the sentiment of other analysts on the call. If time permits, interacting with the company management in person can also provide subtle hints about the future.- Also, going through the company’s investor presentation can reveal important updates about the company. You can also get more information by reading industry research reports. It can give you an idea of where the industry is headed. You can compare that with the company’s future plans to gauge the company’s future prospects.

- Though it would be a time and energy-consuming effort, reaching out to channel partners (distributors, suppliers, etc)

and company employees can also provide valuable insights to bolster your understanding of the company’s future.

and company employees can also provide valuable insights to bolster your understanding of the company’s future.

A company’s shareholding pattern can also provide some indications about the future of the company. Particular attention should be given to the big buying or selling of the company shares by the management. Management that has a lot of skin in the game (own a lot of company shares), is naturally inclined to act in the best interest of the company. In that respect, any big buying of the company shares by the management team is generally a positive indication of the company’s future and vice versa.

Even with all this research, the stock could underperform. But hopefully, by understanding the company’s future better, you will be right more often than not.

Below is a nice graphic version of the above information.

Disclaimer: The information provided here is for information purposes only. It should not be taken as investment advice. Please consult your investment advisor before making investment decisions.